Spending too much time on payroll?

Spending too much time on payroll?

Worrying about IRS penalties? Paying a lot for payroll services?

We offer a full service payroll solution that is customizable for your small business (1-150 employees)needs.

Each pay day, just provide us with employee hours and we’ll take care of the rest.

We provide:

- Support for wide range of pay types

- Sick, vacation and holiday pay accruals

- Federal, state and local tax calculations

- Voluntary deduction calculations

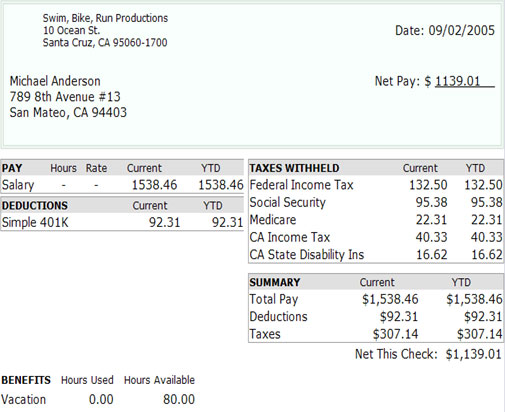

- Paycheck printing

- Direct deposit with detailed pay stubs

- Secure online employee access to pay stubs

- Contractor payments

- 100% accuracy guarantee

You never have to worry about upcoming tax obligations….we take care of everything.

You never have to worry about upcoming tax obligations….we take care of everything.

This includes:

- Federal tax deposits

- Quarterly 941’s

- Annual 940’s and 944’s

- Employee W-2’s

- 1099 MISC filing

- State tax deposits

- Quarterly state tax forms

- Annual state tax forms

You’ll get plain-language, detailed reports so you always have the big picture at your fingertips.

Our detailed reports include:

- Payroll Summary

- Total Pay

- Tax Liability

- Paycheck Details

Workers Comp.

Workers Comp.- Taxes and Wages

- Last Paycheck

- Vacation & Sick

- Contractor Payments

- Deductions

- Total Cost

- Contractor Details

You can rely on us for top quality service – all year long!